Local meal tax under consideration

MATTAPOISETT — Diners in Mattapoisett could see a small increase on their bills in the near future. At a virtual Board of Selectmen meeting on Sept. 8, members discussed proposing a local meal tax as a way to boost town revenue amid significant uncertainty for the next fiscal year.

The measure, which was created within the FY2010 state budget, allows communities to enact a 0.75% local tax on restaurants and take-out meals on top of the 6.25% state tax.

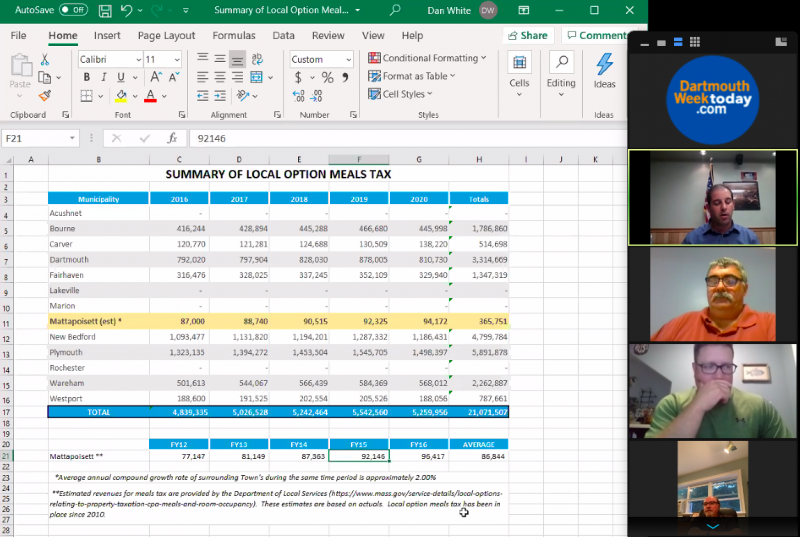

Estimates provided by the Department of Local Services showed that Mattapoisett would have collected $365,751 since 2016.

Town Administrator Michael Lorenco said this would be one of many ways the town could boost revenue without having to increase property taxes, noting the town could see a $90,000 revenue increase beginning next fiscal year.

“It’s a fairly straightforward tax,” he said. “Most communities in Massachusetts already have this in place.”

Vice Chair Jordan Collyer said the town didn’t initially propose the tax in 2009 because it was unsure what the revenues would be. Seeing how other towns have fared since, Collyer said this kind of tax “would certainly be a help.”

“That’s nearly $100,000 we could offset,” he said.

Chairman Paul Silva agreed, saying “that’s a significant amount of money for the town.”

Ultimately, Selectmen decided to further discuss the matter with local businesses and other members of the community. If approved, the proposed tax would go in front of Town Meeting.

“It’s definitely worth exploring,” Silva said.