Rochester Selectmen approve tax rate

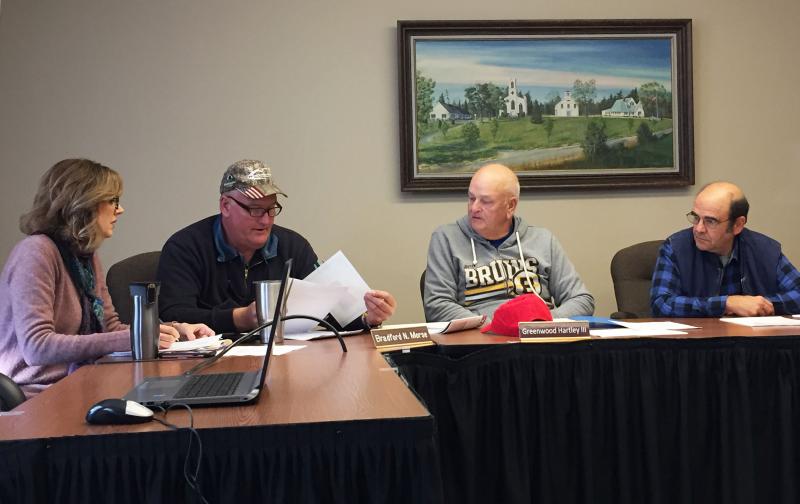

ROCHESTER — Selectmen voted on Friday to retain the town’s single tax rate classification policy and to decrease the property rate for the year at a Classification Hearing with the Board of Assessors.

The purpose of the Classification Hearing was to decide if the town will continue using a single tax rate for all property classes or to use a split tax rate, which shifts the tax burden from residential to commercial properties.

The Board of Assessors recommended that Rochester remain with the single tax rate of $14 per $1,000 of property value, a decrease of 11 cents from last year.

“The state says that you can adjust the tax burden on the commercial up to 150 percent of what is right now,” explained Assessor Charles Shea. “That $14 tax rate can turn into, very simply, $21 against the commercial properties.”

Under a split rate tax rate, the commercial properties would pay the $21 per $1000 and residential would pay a maximum of $12.86. The average single family home is valued at $384,200 and, if there was a shift, the savings for a homeowner would be $439.27.

Selectmen did not move forward with the split tax rate and agreed with the Board of Assessors’ recommendation, approving the single tax rate for the fiscal year 2019.

Though the tax rate went down, Shea said residents will have higher tax bills because of rising property values.

“It’s an inverse relationship,” he said. “As the values go up, the rates go down.”

According to Shea, the tax bill for the average single family home would have an approximately $200 increase this year. He added that the tax bill for average condominium, valued at $375,578, would increase by about $72.

This year’s levy on the town’s $950 million of property will generate approximately $13.3 million in tax revenue, Shea reported.