Marion Planning Board should reject solar site

Story Location

United States

To the editor:

A plan for a 20-acre commercial solar farm to be sited in a residentially zone district on Route 6 is before the Planning Board for a special permit and site plan review.

This site is part of the larger 60 acreages of woodlands with multiple ownership located near the corner of the Point Road and Route 6 intersection extending to the Weweantic.

The Town has provided commercial solar access with matter of right zoning at the land fill. That’s where this project needs to be sited and not in a high value developable residentially zone district.

Marion already has two taxpayer subsidized solar farms located off County Road. By facts and law, the Planning Board has the voting control of this project’s future. There is no developer right to receive a special permit for solar development on this site.

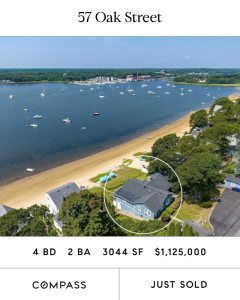

The site is one of the few large open parcels remaining available for potential development with proper zoning. The Planning Board should look at rezoning this area for the land’s best use. Given its location zoning such as for high end mixed use would be a significant benefit for the Town and land owners too. This work could be completed in time for the Spring Town Meeting.

For example, $20,00,000 of high-end projects would generate about $ 230,000 in annual tax revenue subject to the future tax increases we all look forward to paying.

Commercial solar gardens are tax exempt meaning Marion taxpayers would be subsidizing commercial solar development receiving no benefit. Giving up the potential for $230,000 tax generating projects is a very big financial hit for our small Town; a material special permit factor for Planning Board consideration.

As I do, many may consider that outright rejection of this project should be a high Planning Board priority. Its incompatible with the master plan, residential zoning restrictions and has an adverse financial tax impact on the Town and maximizing land use values.

The zoning restrictions on large scale tree clearing necessary for the solar site development cannot be waved or modified by the Planning Board and would not meet the statutory requirements for a variance from the ZBA.

The developer claims Town and residential savings on electricity will be available by purchasing solar credits by operating the project as a solar garden. This claim is a fiction. Solar farms are financial tax products with no economic substance formed to harvest generous subsidies and credits. You are paying for it. There is no cut rate electricity.

The Town already has a requirements commitment under the wind contract. The frequency of solar developers calling you offering saving on your electric bill by selling you credits is epidemic. Most of us are already enrolled in the Town’s consolidated community purchase agreement to save on rates.

There is significant uncertainty for the Town and a developer as to future tax obligations. For this reason, the developer proposes a 20-year agreement for payment in lieu of taxes (PILOT) with the Town.

Any sort of a PILOT, which must be approved by Town Meeting, will be a further taxpayer subsidy. The Town effectively takes on an unsecured credit risk for payments and all project material adverse changes that may be included in such an agreement. This shifts risks to the Town for the benefit of the developer by providing tax stability for the debt financing the developer will be using to

finance the project. No actual developer details have been provided on this issue.

Also, an issue is the dynamics of payment defaults. For projects being taxed as real-estate, the rules of real property tax foreclosure apply including bankruptcy tax priorities.

The Town has a protected tax revenue asset. If the solar equipment payments are in default under the PILOT and payments have not been secured such as irrevocable letters of credit, then good luck collecting from a delinquent or insolvent developer probably located out of state. The Town would stand in line as any other unsecured creditor. The Town would have a solar junk yard with a debtor in possession siting on one of the most desirable parcels of developable property remaining in Marion.

Finally, are the details of the contentious developer negotiations, a material issue, over the zoning bylaw’s required end of project life remediation bond to clean up the project’s decommissioning. This bond requirement protects the Town’s future generations from dealing with a 20-acer junk yard.

If you have an opinion to share with the PB and community on this project, the Planning Board public hearing is still ongoing. The Planning Board cannot accept comments for decision making consideration after the closing of the Public Hearing.

Ted North, Marion