Opinion: On Mattapoisett tax rates

To the editor:

I am writing in response to William Nussbaum’s letter which was published on April 6 in Sippican Week on behalf of the Mattapoisett Select Board. First off, welcome you to Mattapoisett, it is a great town and we know you will enjoy living here.

I know you have already spoken with Town Administrator Michael Lorenco regarding the letter, but we did want to respond and use the opportunity to explain to readers the process of how tax rates are

established annually.

Everything begins on Town Meeting floor in May where all spending for the upcoming year is approved by a majority vote of taxpayers attending Town Meeting. Town Meeting is a culmination of efforts by Town Department Heads, Town Administrator, Capital Planning, Finance Committee, School Committee, Selectboard and many others putting together a balanced annual budget for the town for the upcoming fiscal year. This requires a lot of effort and time on behalf of all parties as the town is constrained by Proposition 2 ½ which restricts increases in property taxes without overrides/exclusions. The Town has not sought an override in more than 10 years which means those involved in the budgetary process for the Town are exercising sound fiscal policy. With debt and new growth included, Mattapoisett’s 5-year average budget levy increase is approximately 3.8%. In the Southcoast region this average is only beaten by Dartmouth and Fairhaven (at 3.7% and 3.4% respectively), two communities with a large commercial presence which helps to offset increases in residential tax rates. Mattapoisett’s average increase bests several surrounding communities including Acushnet, Bourne, Carver, Freetown, Lakeville, Marion, Rochester and Westport over the last 5 years.

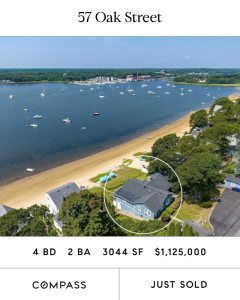

What makes my tax bill jump more than 2 ½%? Over the last few years home values in Mattapoisett have risen approximately 36%. Each year the Massachusetts Department of Revenue mandates that values are adjusted based previous years qualified sales and a full recertification occurs every five years. This data can be the trigger for an increase in assessed value of a residence due to a recent sale in the neighborhood which reflects an increase in property values in the area. This has had the biggest impact on localized increases in property values.

It should be known that the Town’s first two quarterly tax bills are always estimates. The Town typically sets its’ tax rate in late Fall, which results in a “true-up” of the final two quarterly tax bills. So, if you want to know what your true increase in your property taxes is from year to year, you must compare the total annual amount. Your tax bill is calculated by dividing your home’s assessed value by $1,000 and multiplying it by the Town’s approved tax rate. Though the Town may control the budget, the Town has little control over the market price of homes, and thus their calculated assessed value.

The effective tax rates in Mattapoisett in the last 3 year have been the following:

2021 Tax Rate: $12.96/$1000 assessed value

2022 Tax Rate: $12.40/$1000 assessed value

2023 Tax Rate: $11.25/$1000 assessed value.

Over the same time period, the Town did not require the full 2.5% increase as permitted by law resulting in excess capacity if needed.

Everything discussed in this letter is also discussed at public meetings, on Zoom and are recorded and available on the Town Website. A lot of effort and thought that goes in to annual Town spending, and ultimately the decisions to spend taxpayers’ money is made by a vote of Town Meeting in the spring or fall. The Select Board takes our job very seriously when it comes to endorsing spending articles on the

Town Meeting Warrant, and if approved, our duty is to follow through with the “Will of Town Meeting” and take actions to facilitate all matters approved at Town Meeting.

Hoping to see all of you Town Meeting on Monday, May 8!!

Respectfully.

R. Tyler Macallister, Chair, Mattapoisett Select Board